WATCH: The next 6 months of AI in private equity

Infrastructure, misconceptions and deal origination

AI is transforming how private equity firms identify and assess opportunities.

But as the team from Filament Syfter: Phil Westcott (CEO), Martin Pomeroy (Co-founder, Technology), and James Ede (VP of Clients) discuss in this short video, the firms that will gain the most ground in the next six months are those laying the right foundations, not chasing the next new tool.

Duration: 2 minutes 57 seconds

Watch Phil, Martin, and James explore:

-

How to build the data ecosystem that fuels your AI roadmap

-

Why adaptability matters more than speed

-

How AI and generative models are transforming deal origination

Start with your data ecosystem

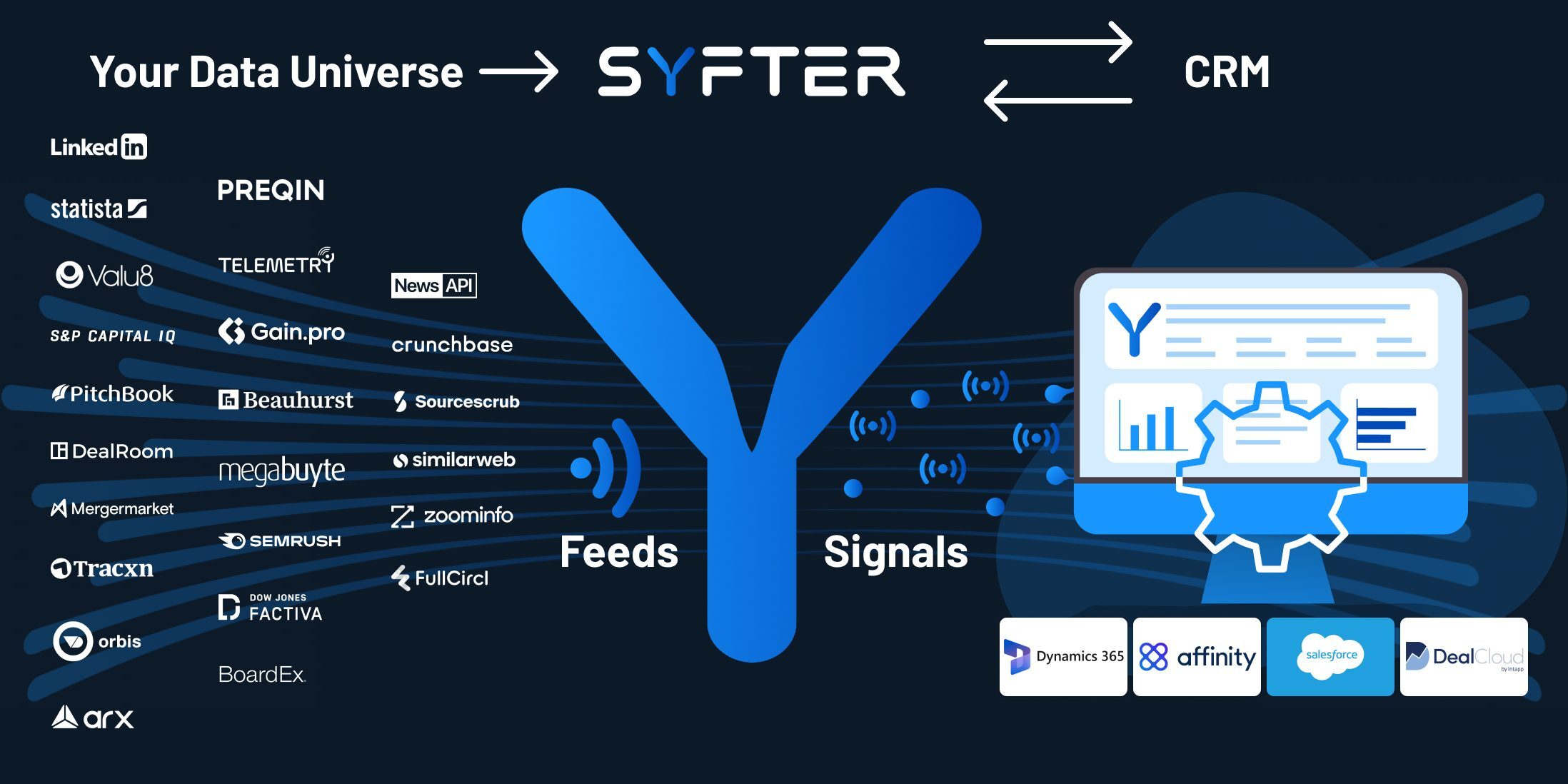

The first and most important step, says Martin, is to build the data ecosystem within the firm. That means connecting your CRM, document management system, and private market data sources so they work together.

This integration creates an internal knowledge base, the fuel that powers your AI roadmap and gives every team across the firm a clearer, faster way to work with data.

It’s not as big or as scary as it sounds

James highlights a common misconception: many firms think creating this ecosystem will be a huge, time-consuming project that needs to be completed at record speed to keep up.

In reality, it’s far more manageable than that. Starting small and building iteratively can deliver quick wins while laying the groundwork for long-term success.

“It’s not big and scary,” as James puts it. “That’s the most important thing to remember.”

Build for change, not perfection

AI is evolving daily, so flexibility is key. Phil explains that the most effective firms are those designing systems that can plug in new tools and adapt to ongoing advances, rather than locking themselves into a single vendor or static architecture.

The goal isn’t perfection; it’s to build a foundation that can evolve as AI does.

One clear priority for the next six months

All three agree on one thing: if a firm does just one thing in the next six months, it should be to establish a unified data strategy.

Integrate your systems, align your data, and create a clear view of how information flows across the firm.

That single step sets the stage for everything that follows, from analytics to automation to true AI-driven advantage.

How AI is already reshaping deal origination

Martin points out that AI is already being used to improve deal origination by extracting insight from unstructured data—helping identify whether a company is a system of record, whether it sells B2B or B2C, and how it aligns with a firm’s investment focus.

Generative AI will take this further, learning from a firm’s behaviour and investment patterns to make connections and apply reasoning, much like a new analyst learning the ropes.

To find out more about how deal teams and tech teams can get started with AI and data connectedness, find out more about Filament Syfter today.

.png?width=1107&height=367&name=VIDEO%20-%20Getting%20serious%20about%20AI%20in%20private%20equity_%20the%20first%20steps%20(1).png)