The Shape of Your Data – selecting the right blend of private market data sources to suit your Deal Origination strategy

For Private Equity, selecting of 3rd party data providers is key for optimizing their deal-sourcing effectiveness. However, the practicalities of reviewing multiple data platforms to gain market coverage and create a single, timely view of the market pose significant challenges. In our last blog, we covered the challenges, and respective solutions, that primarily stem from the presence of data adoption within private equity firms – this piece will cover how PE firms can achieve the ideal shape of data necessary for origination and deal sourcing teams, or what we like to call – the 360-degree view.

The Landscape

PE firms often encounter a complex landscape of 3rd party data providers with different specialties and market coverage, such as financial data, transaction data, people data, and news data. Their market data is scattered across various platforms and formats. In PE deal sourcing, a team will go through a rigorous analysis of over 80 investment opportunities before making one investment, meaning the art of down-selecting the best opportunities is crucial to the firm’s efficiency, performance and outcomes. In other words, “How can you weed out bad deals earlier in the review process?”

What Are The Key Issues

A centralised location

PE professionals must look at information from various sources to understand their potential investments. This can be difficult because they must navigate multiple systems and manually reconcile data to obtain a comprehensive view.

Disparate pipelines & data fragmentation

Fragmented sources lead to data quality issues, including errors, duplications, and inconsistencies, compromising the reliability of the analysis. Bridging data gaps across regions and business types is essential for gaining a holistic view of the market landscape.

Data reconciliation and duplication

Managing multiple pipelines often leads to data consistency, including overlapping or duplicate entries. This can result in inaccurate analysis and decision-making, requiring labour-intensive efforts to reconcile and de-duplicate data.

Data latency and delays

Different data pipelines may have varying update frequencies, causing delays in accessing the most recent data. This hinders timely decision-making and may lead to missed opportunities.

Integrating data from multiple pipelines

Incompatible formats and structures across systems require significant effort to harmonise the data for meaningful analysis. This complexity further consumes time and resources.

How can Filament Syfter help PE firms achieve data excellence?

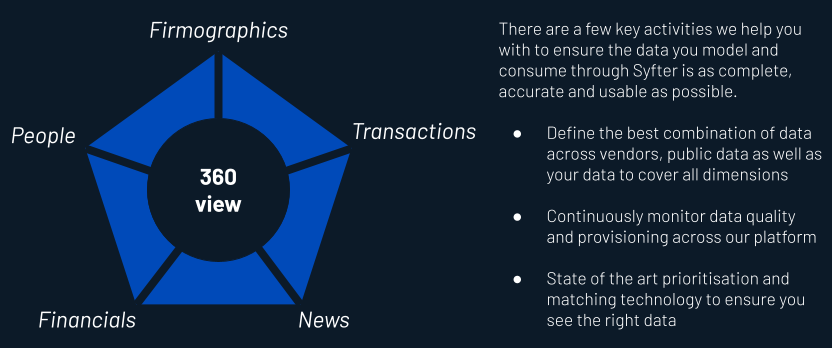

Syfter offers a range of key functionalities and services that enable PE firms to achieve a 360 view and ensure that the data used for modelling and analysis is complete, accurate, and usable.

To get a 360 view, a few key dimensions are required:

Let’s explore the key activities supported by Syfter:

One central location:

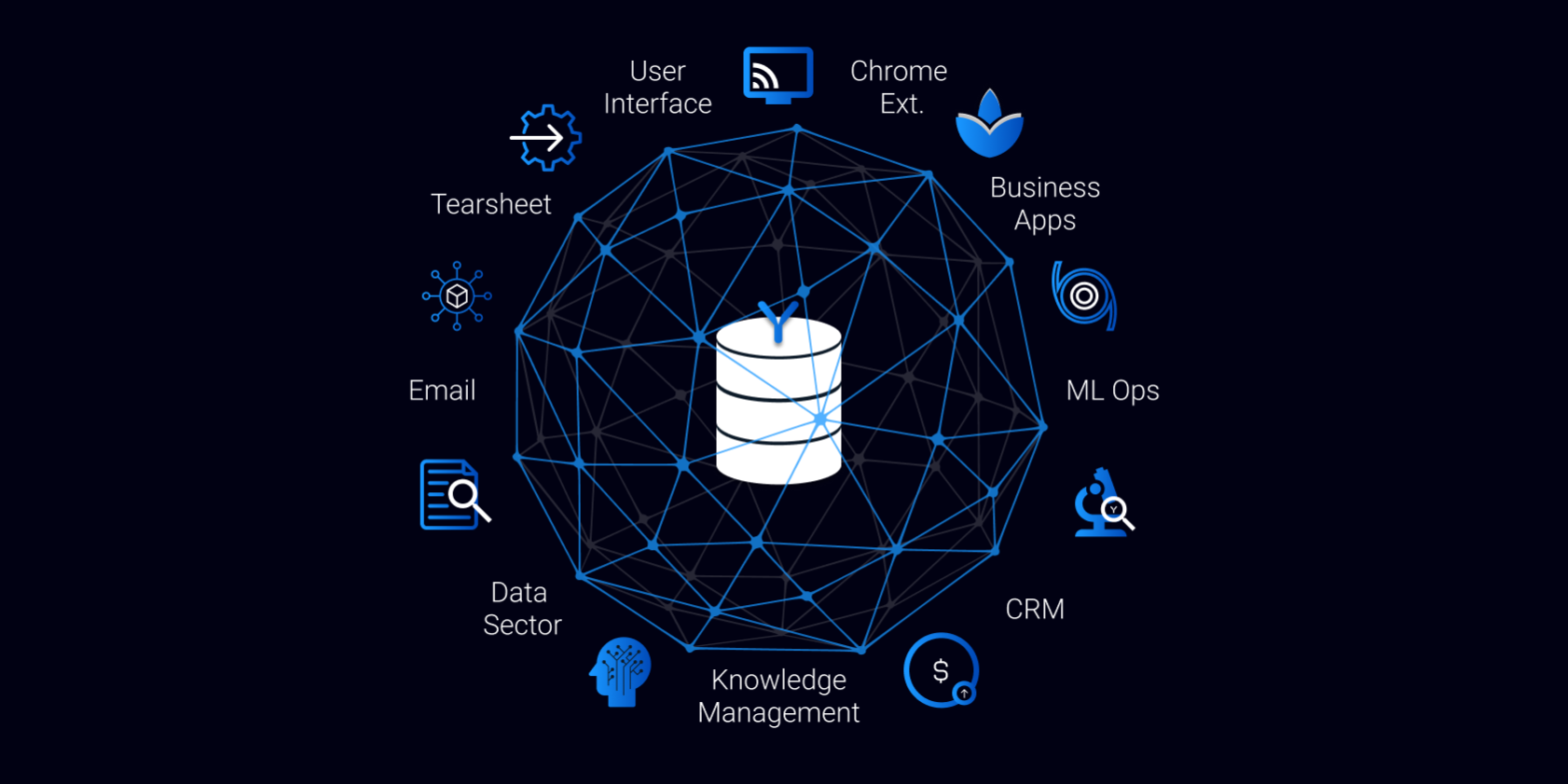

Syfter provides PE firms with streamlined data aggregation and analysis by providing a unified platform interface that connects to different data sources and automates merging conventional vendors with any manner of alternative data, effectively employing cutting-edge technology to stitch datasets together and create a single source of truth that can then feed all other knowledge management systems.

Defining the best combination of data:

Syfter allows private equity professionals to define the optimal combination of data from various sources, including vendors, public data, and proprietary data. This capability covers all relevant dimensions, providing a comprehensive view of informed decision-making.

Continuous monitoring of data quality:

Syfter incorporates robust data quality monitoring processes. By continuously monitoring the data quality and provisioning, the platform helps identify any issues or discrepancies, ensuring the integrity and reliability of the data. This proactive approach enables timely data corrections and enhances the overall accuracy of the analysis.

Data Completeness and Accuracy:

Quality and completeness of data sets are critical in private equity decision-making. Syfter helps you ensure comprehensive data coverage, minimizing gaps and inconsistencies. By reducing reliance on inferred data, which may introduce inaccuracies, Syfter enhances the accuracy of analysis and decision-making.

Coverage across Regions and Business Types:

Syfter helps you address the challenge of data coverage across different regions and business types. The platform offers comprehensive data sets encompassing various geographic regions and business categories. This broad coverage enables private equity professionals to evaluate opportunities across diverse markets and industries, reducing the risk of missing out on valuable insights.

Representation of Smaller Bootstrapped Businesses:

For PE firms looking to track emerging businesses that sometimes fly under the radar, including a data source that provides coverage of bootstrapped businesses is helpful. SourceScrub is a good example… The platform ensures their representation, allowing private equity professionals to access valuable insights and evaluate investment opportunities even in niche segments. This inclusive approach enhances the comprehensiveness of data analysis.

By leveraging Syfter’s capabilities, private equity firms can achieve data excellence. The platform enables them to define optimal data combinations, continuously monitor data quality, ensure data completeness, and broaden coverage across regions and business types. With Syfter, private equity professionals access a powerful tool that empowers them to make more informed investment decisions and drive successful outcomes.