Unleashing the Power of Integrated Data: The Filament Syfter Advantage for Private Equity Firms

Introduction:

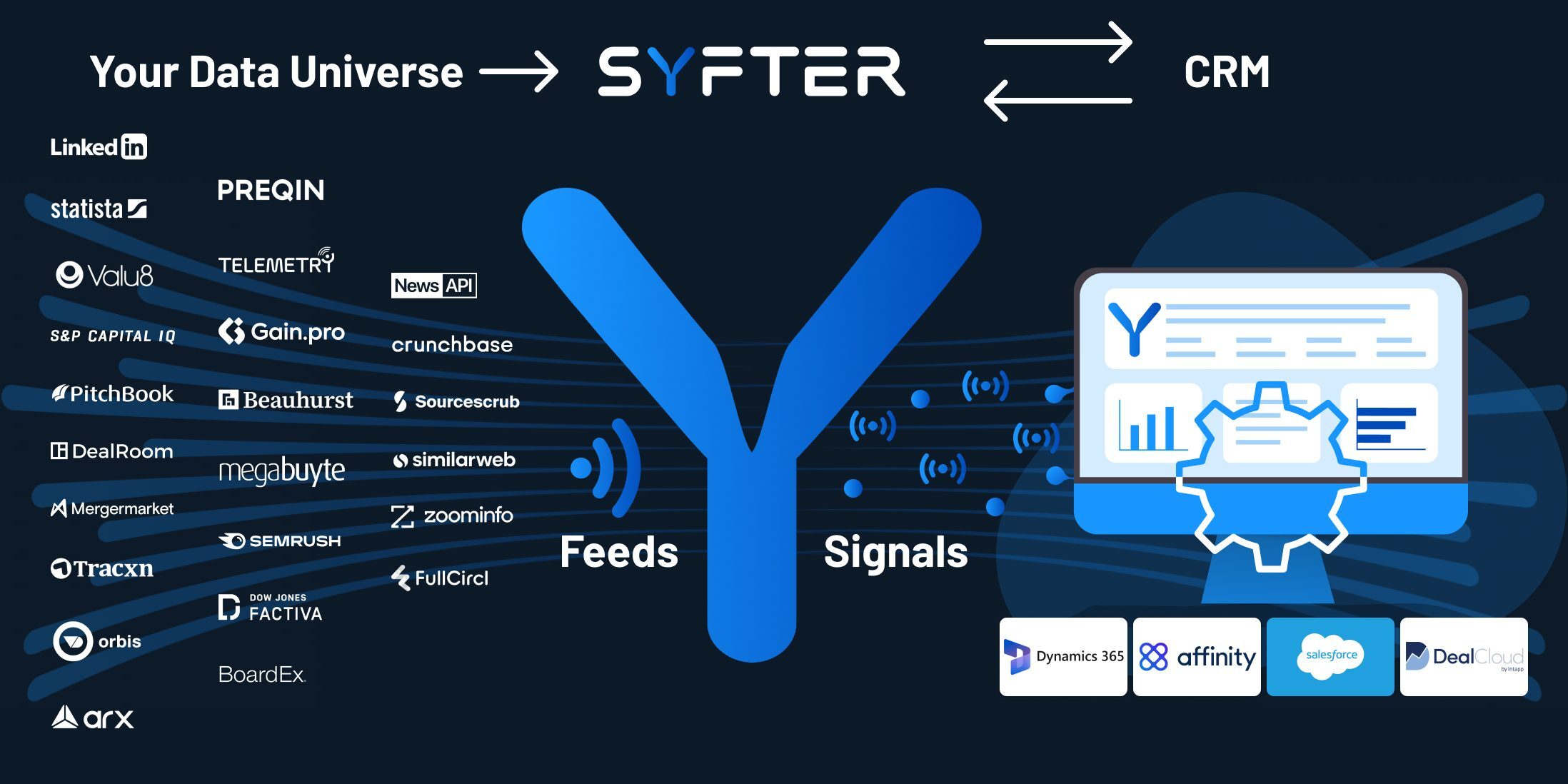

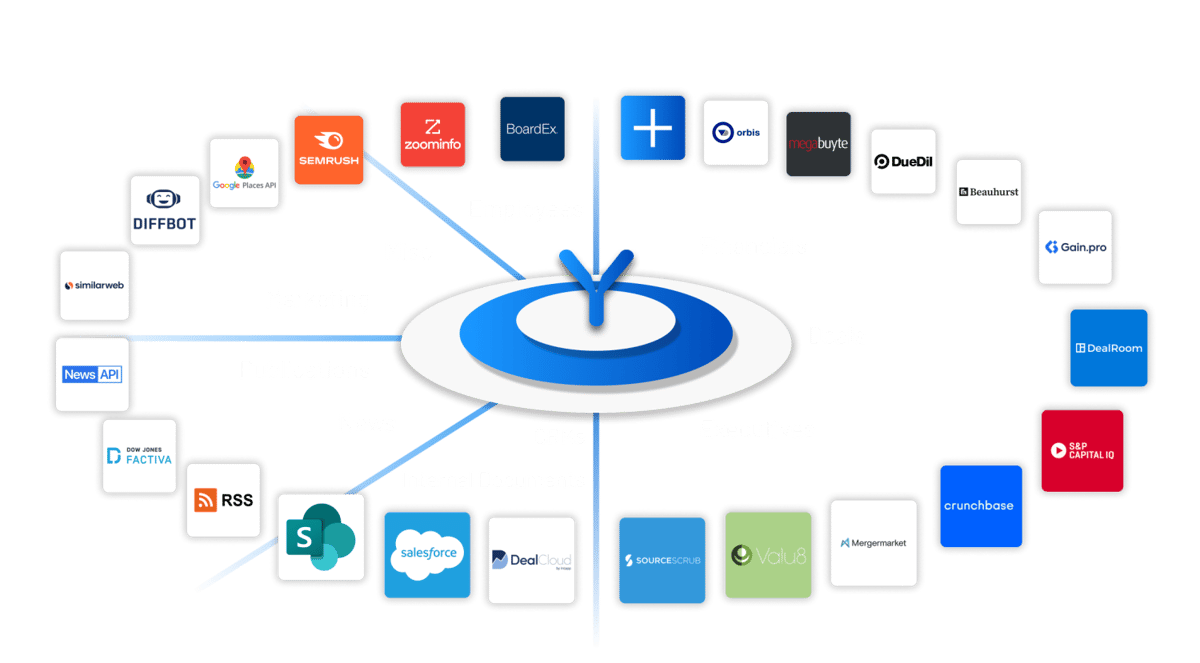

Private Equity Firms require comprehensive and accurate data for their decision-making process. However, most of them rely on disparate data sources from various providers to cover necessary aspects such as firmographics, people, news, financials, and transaction data. Filament Syfter addresses this challenge with its advanced data integration ability. Our cutting-edge technology, backed by years of expertise, enables private market firms to develop their own proprietary data and AI platforms, where all of their external, internal and CRM data is connected in one location. Additionally, it supports these firms in establishing a sustainable, long-term data strategy. This approach is crucial for these firms as they navigate through the vast amounts of data in today’s investing landscape.

Building Your Data Backbone:

The key to unlocking the full potential of your data lies in its seamless integration. Our white-labelled platform is designed to effortlessly integrate with your existing data infrastructure, offering a turnkey solution for private equity and investment banks seeking to develop their own proprietary solutions. With over six years of dedicated problem-solving and experience supporting the world’s leading private equity firms, we’ve distilled and productized the essential data engineering and AI tools required to help firms build their internal assets at a fraction of the cost and time to deployment.

A 360-Degree View:

With pre-integration with all major market data providers, Syfter empowers private equity firms to take control of their market intelligence. Seamlessly connecting with your CRM and internal documents, our platform provides an unparalleled 360-degree view of every company in your addressable market. This means monitoring up to a million companies a day, ensuring that your analytical data remains secure and in-house.

Empowering Efficiency:

The Filament Syfter advantage lies not only in integration but also in efficiency. Our platform consolidates and automates origination and market monitoring processes, eliminating the need for cumbersome, disjointed workflows. By centralizing your data and providing the tools to interrogate and enrich it, we free up valuable time and resources for your team to focus on what truly matters – making informed investment decisions.

Maintaining Your Edge:

In a landscape where every edge counts, partnering with Filament Syfter is the strategic advantage your firm needs. Our platform allows you to deploy within weeks, rapidly accelerating your technical capabilities at a fraction of the time and cost of building in-house. Furthermore, our ongoing support ensures that you stay at the forefront of the latest advancements in private market data and applied AI.

Conclusion:

Filament Syfter is not just a platform; it’s a catalyst for transformation. By integrating third-party data sources, internal documents, and CRM systems seamlessly, we enable private equity firms to build their own data powerhouse. With Filament Syfter as your partner, you’re not just investing in a platform – you’re investing in the future of your data strategy. Unleash the power of integrated data and stay ahead of the curve with Filament Syfter.