How investment firms can use AI to gain market intelligence and a strategic advantage: An exec perspective

Syfter Team | 28th April 2020

Private equity (PE) executives are constantly looking for ways to give their firms a strategic advantage by differentiating their investment strategy, finding ways to stand out during fundraising, and building up a world-class team and reputation.

On top of all this, they have operational responsibilities that centre on identifying potential new investment opportunities and growing their firms’ portfolio businesses. Clearly, they have a huge amount on their plate. Every decision can be critical – the difference between success and failure.

For example, PE firms are always seeking to gain an edge over the competition by being the first to engage promising companies, or to re-engage with companies whose circumstances or “investability” have changed. They then need to stay ahead by tracking their pipeline on a daily basis, so that they are best placed to evaluate and ultimately win the right deals. Speed is paramount, potentially giving firms access to exclusive deals and enabling them to avoid costly auction processes – which can significantly eat into future profits. Although individual deals can take months to complete, the need for the right information is constant.

Roadblocks ahead

Of all the issues that can hinder an investment firm’s growth, the level of competition in the industry is arguably the most significant. PE firms constantly have to be on the lookout for potential deals and for the most efficient ways to manage the deal process to stay ahead.

As such, when it comes to leading the way in the world of private equity, speed and market intelligence are the orders of the day. Not only do PE executives need insight into everything that is happening in their sectors of interest, they also have to be able to access this information before anyone else.

This requires each firm’s team of analysts to constantly be on top of current data from a wide range of sources. They need to be able to monitor hundreds or even thousands of companies as efficiently as possible and pick out nuggets of information in near real-time. Ultimately, the goal is to identify those key pieces of information that might lead to a transaction ahead of another firm.

On the post-acquisition side, the focus shifts to monitoring for information that will help increase the value of a portfolio company. This involves identifying potential add-on acquisitions, any relevant moves in the market – especially by direct or adjacent competitors – and potential growth opportunities.

However, with so much ground to cover and so much information to distil, this is all a significant challenge. And not getting it right can have a long-term impact. For example, deal origination is sometimes performed for the fund by external investment bankers, who will also be sharing those opportunities with rival firms.

But modern technologies can now allow PE firms to get on the front foot. Artificial Intelligence (AI) and machine learning-powered tools that are geared towards firms’ specific investment goals, can help them gain a potentially lucrative strategic advantage over their competitors – as well as supporting long-term business growth.

Changing the game

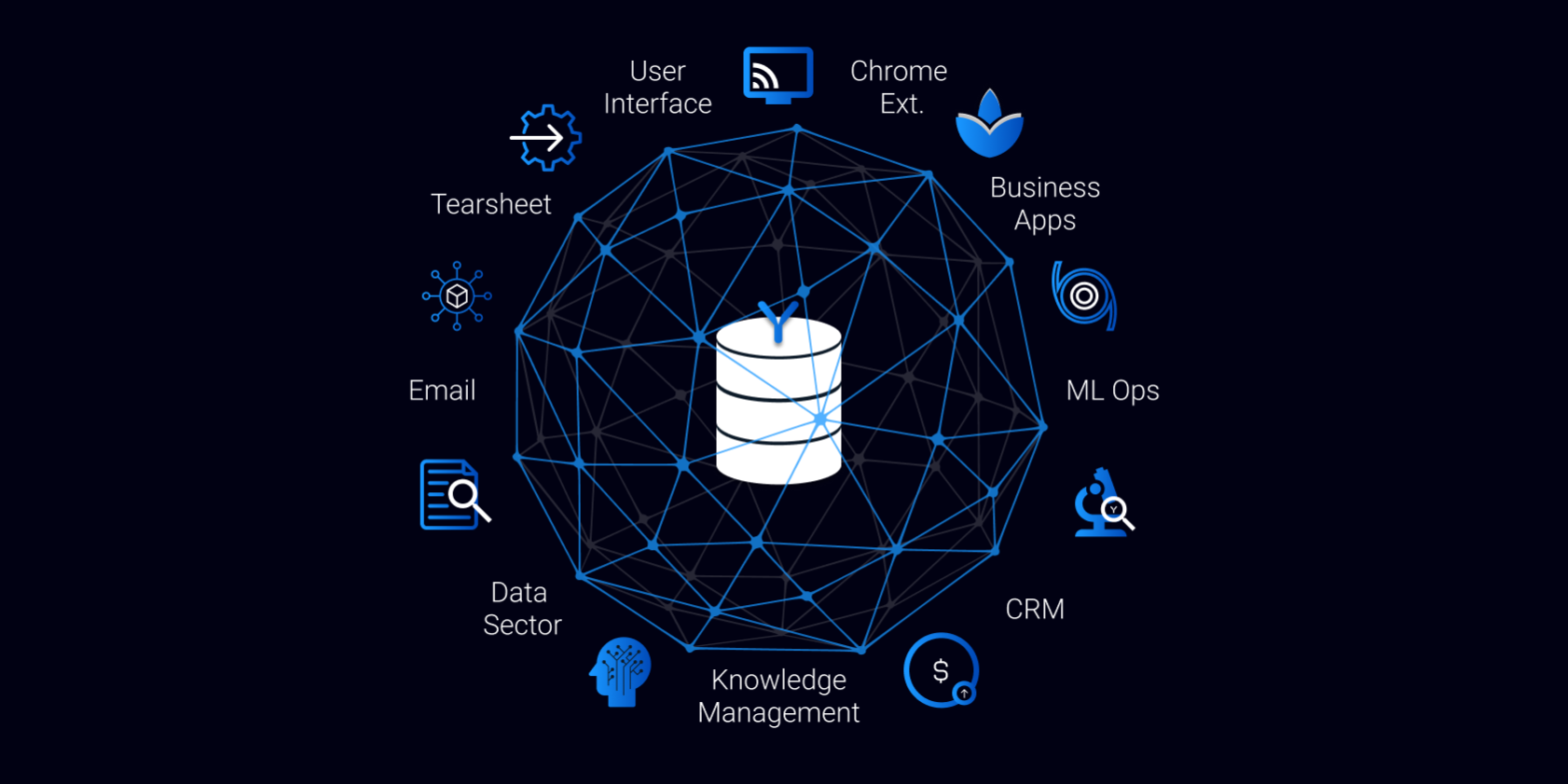

Faced with so many pressures, AI platforms such as Syfter help firms gain an all-important competitive edge by increasing their market intelligence. Integrating AI technology can enable them to cover more ground in deal origination research and analyse more data points in initial and follow-up investment decisions – meaning they don’t have to rely on external sources. Instead of tracking a handful of companies, firms can track all companies which meet their investment criteria without needing to grow the size of their analyst teams.

The key to making AI work for PE is ensuring that the machine learning models can be structured around each firm’s unique investment thesis. Each investment house will look for particular tell-tale signs in market movements or potential targets. These need to be mirrored in the way the AI platform discovers data, giving each user their own unique model. Set up in this way, AI then becomes far more than just a basic search function – it adds a layer of sophistication to research and discovery that is otherwise impossible to achieve at scale.

In addition, PE firms have used their AI platforms during fundraising as a means of grabbing the attention of potential investors. The ability to scale research and monitoring by investing in an AI platform provides a valuable differentiator, while highlighting that they will be using their investors’ money in a smart way to get out in front of every deal.

Finally, in addition to the PR aspects of fundraising, the operational process itself can benefit from AI and machine learning techniques. In a traditional PE environment, fundraising involves manually calling relevant institutional investors one by one – an extremely time-consuming endeavour for senior executives. AI can significantly streamline this process by enabling more targeted fundraising campaigns.

The combination of these factors highlights the power of AI tools such as Syfter. From helping to discover new investment opportunities, to driving better market intelligence and increasing productivity, AI can equip firms with a powerful strategic advantage that could make all the difference in an increasingly competitive world.