AI, Data and Deal Sourcing Best Practices for Private Equity

AI, Data and Deal Sourcing Best Practices for Private EquityPrivate equity deal sourcing has always been a complicated, time- and data-intensive process. But in the rise of artificial intelligence (AI), firms are learning that only the most sophisticated and technology-enabled deal sourcing strategies win.

To learn more about best practices for private equity deal sourcing trends, Filament Syfter hosted an exclusive webinar with leading technologists and dealmakers. In this article, we’ll summarize the key insights shared by esteemed panelists Max Haskin of FINTOP Capital, Rory Cooke of Inflexion, and Peter Morrison of Vitruvian Partners - all of whom joined Filament Syfter Founder and CEO, Phil Westcott.

Continue reading for insights on the overall state of private capital markets data management and the persistent challenges of deploying artificial intelligence in an increasingly complex technology landscape.

Private equity’s moment of truth: How to know it’s time to upgrade and operationalize the tech stack

No matter a private equity firm’s AUM or strategy, there always comes a moment in time when the firm decides it needs to mature its use of technology. According to Max Haskin of FINTOP Capital, “the industry at large suffers from siloes of data. Many firms have made big investments of time, data, and resources for master data management strategies, but technologists are beginning to ask ‘so what?’” If firms can’t derive specific insights and intelligence from the existing technology deployments, they will soon have motivation to expand the capability set so those siloes can be reduced.

Motivation within a private equity firm can take many shapes, as was discussed on the webinar. “Vitruvian Partners are a technology investor so we felt strongly that we needed to be on the front foot of data science and AI. Our Managing Partners helped us to kick off a research program over the course of a year to explore the different use cases we could apply internally and what vendors existed for each,” said Chief Technology Officer Peter Morrison. “Once we completed the initial use cases, we expanded our scope and continue to innovate today.”

According to Rory Cooke of Inflexion, “we needed a scalable way of sharing information across 9 different countries. 10 years ago, everyone sat in the same room and sharing information was easy. That way of sharing information just doesn’t scale, so that was one of the drivers,” Cooke said. “At Inflexion, we wanted to invest in data lakes and our data aggregation systems as a way to practice what we preach to our portfolio companies, investors and other stakeholders.”

Buy vs. build: Decision-making rationale and key considerations

After the motivation and necessity for change has been established by a private equity firm, the next step is to decide whether to buy or build the technology solution. Deciding between the two options isn’t always easy. On the webinar, private equity technology leaders shared their rationale behind deciding to buy purpose-built technology like Filament Syfter in order to fulfill their goals.

According to Pete Morrison of Vitruvian Partners, “building is a difficult nut to crack.” While Vitruvian did explore the option to build their own solution seriously, now the firm feels grateful they decided to buy.

Further to that point, “building your own technology is very alluring, especially when you come from data science background,” said Rory Cooke of Inflexion. “When you think there’s some intellectual property (IP) and secret sauce in what you’re doing, you may worry that you will lose some of that by buying from an off-the-shelf provider. But having explored the build route, that allure fades very quickly especially when you begin to appreciate the complexity around entity recognition, data matching and whatnot.”

Optimizing for experience: How the data ecosystem influences day-to-day dealmaking

In the journey to modernizing the technology stack, it’s important for firms to consider exactly how any new technology will be leveraged internally. According to Inflexion, their biggest learning was that user experience is “more of a personal thing, rather than being stratified out by role,” Cooke said. “Some professionals are very open to technology helping them do their job while others are more set in their own workflows and ways, so it’s important to find technology solutions that allow for that flexibility.”

For Virtruvian Partners, the key to making the day-to-day experience a positive one is enabling dealmakers to gain access to information in a structured way. “Whether intelligence comes from the CRM, an attendee list from a conference, a referral from an advisor, or other source, we want the deal team to have precise information at their fingertips and feel comfortable that the information is correct and without any hallucination,” said Peter Morrison at Vitruvian Partners. “If there’s one thing that the deal team is poor in, it’s time. So now we’re building mini use cases for the operations of the deal team to help them get from A to B in an efficient manner.” In doing so, firms like Vitruvian can gain meaningful time savings and deliver more value back to the limited partners (LPs).

“The firms that win are codifying their strategy into a technology and making that a big part of the culture of the firm,” said Max Haskin of FINTOP Capital. “From what I see, it all comes down to the discipline within the firm to use the technology as planned and is much less about the specific technology itself.”

No matter what, private equity technology leaders agreed that - as best practice for improving the dealmaker experience - all systems should have interconnectivity without duplication, especially between CRMs, chatbot, and distinct solutions.

AI roadmaps: Where private equity firms are today and what’s ahead

Private equity firms are under increasing pressure to move faster, uncover unique opportunities, and generate outsized returns. AI is quickly becoming a strategic lever, transforming how firms source deals, evaluate targets, and drive portfolio company performance. But deciding how to deploy AI within a firm is anything but a simple task. To learn more, we asked the panelists to highlight their thinking around their AI roadmap and to share key considerations.

“For us, we’ve been working on exploring large language models (LLMs) to solve various problems as well as agentic frameworks and those AI providers that have private equity-specific offerings,” said Peter Morrison of Vitruvian Partners. “Broadly speaking, we’re focused on creating the AI use cases that our dealmakers can leverage each and every day.”

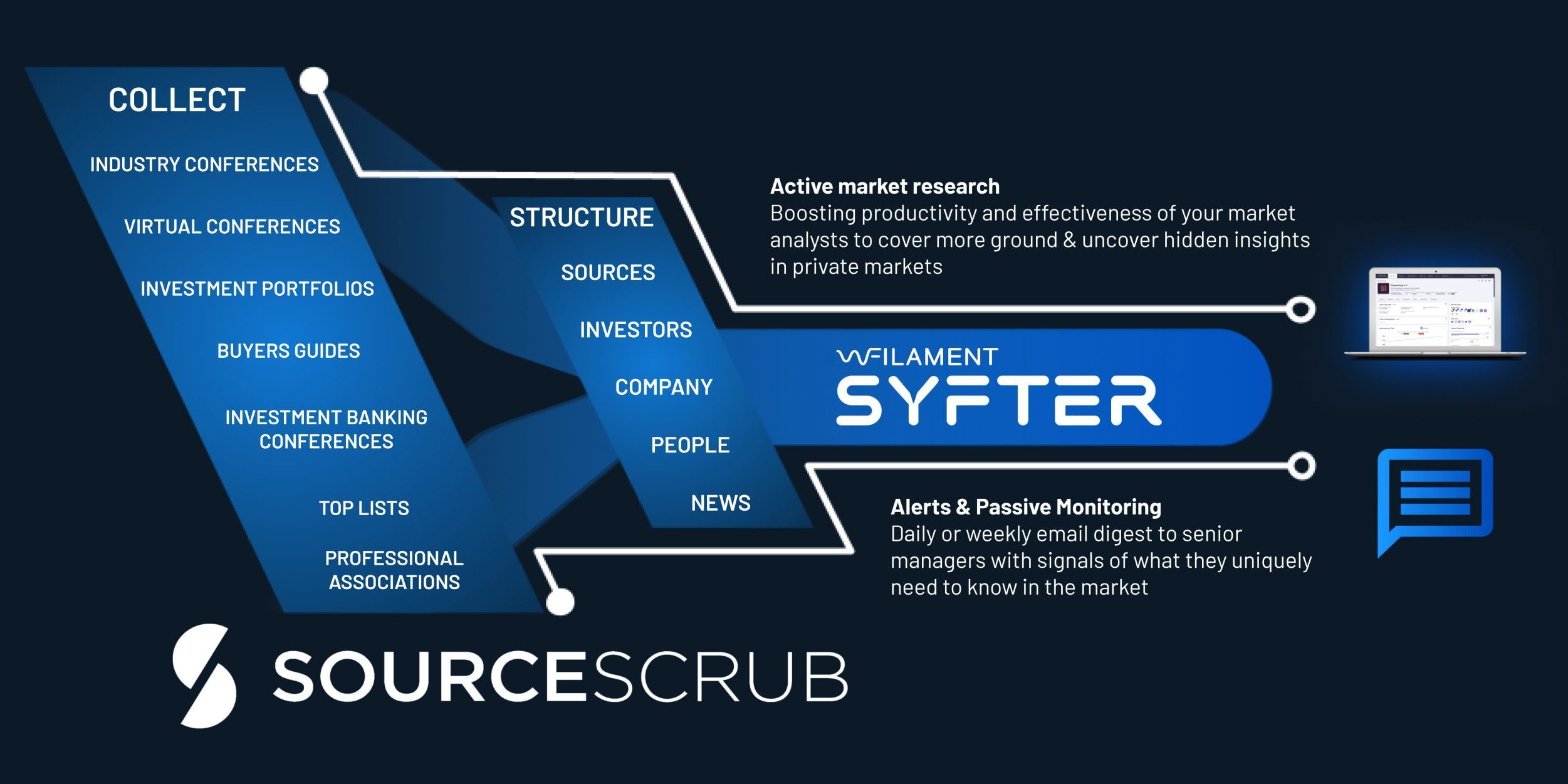

As for Inflexion, their process for analyzing AI in their private equity firm began with with getting a clean data set and ensuring the data foundation is solid. “In terms of AI deployment to date, we’ve been hyper-focused on narrow use cases that have arisen from a survey of the dealmakers,” said Rory Cooke. “From that, we’ve decided to deploy AI for process automation of tasks in the back office, document classification, and website scraping via Filament Syfter to identify companies in niche sectors.”

For FINTOP Capital, there are several key AI use cases that their firm is very excited about. The first is market mapping, which Max Haskin defined as “the ability to very quickly understand a company’s competitive set, the end market that company sells into, the underlying trends affecting that end market, scenario planning around bull and bear cases, and other such research efficiency gains.” The other key area of focus for FINTOP is deal due diligence. “We can now enter a deal data room and interact with the documents in a GenAI chat interface and that has fundamentally changed the way we do diligence on our own investments,” he said.

Conclusion

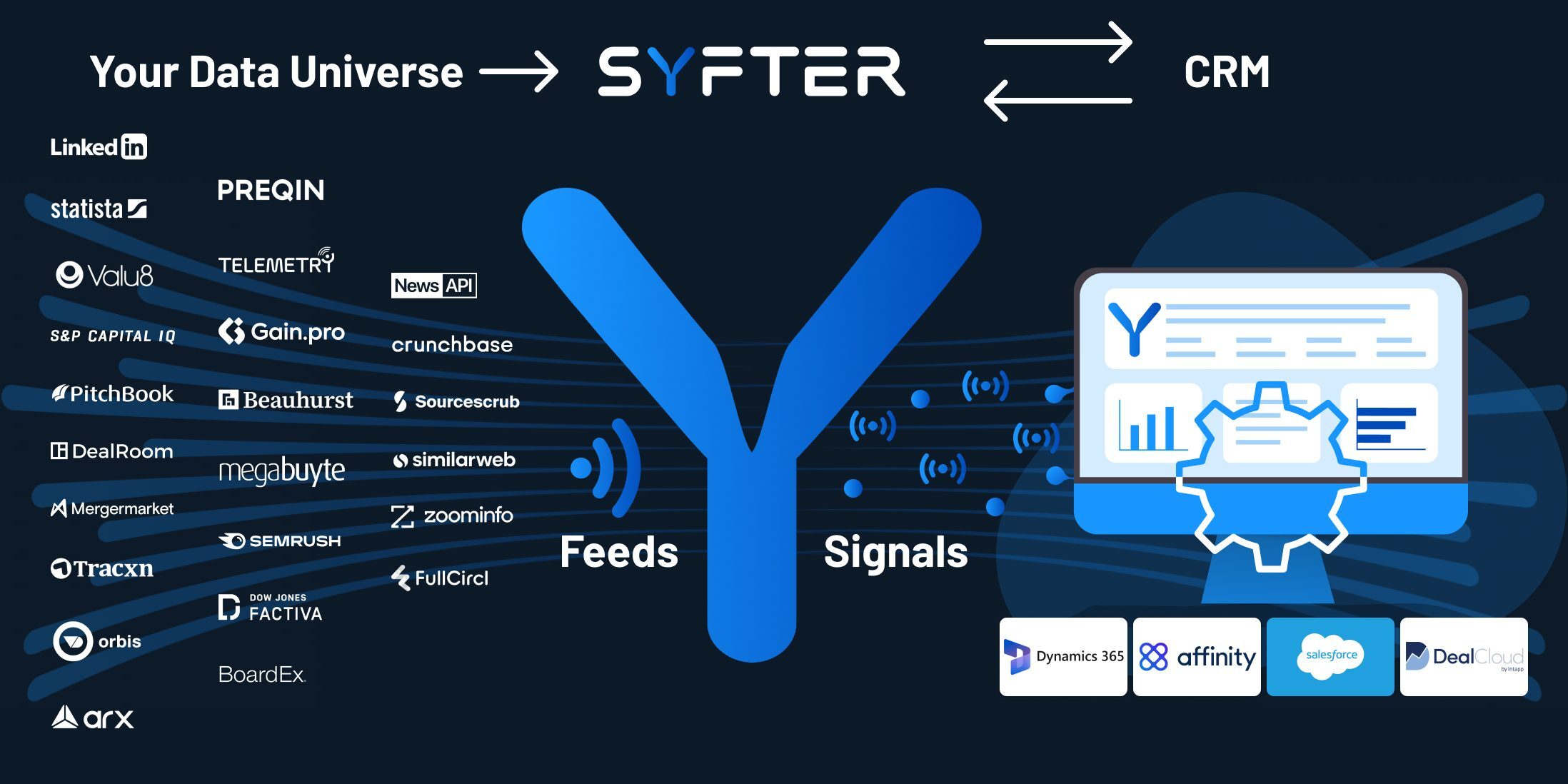

Private equity and investment banking firms are sitting on a goldmine of data, but without the right tools, that data remains untapped. Filament Syfter turns that data into a strategic asset, helping deal teams source more effectively, reduce missed opportunities, and future-proof their operations. Whether you're looking to gain a competitive edge or simply get more ROI from your existing systems, Filament Syfter can help.

Ready to see the power of your data in action? Book a demo with Filament Syfter today and discover how smarter dealmaking starts with smarter data.

Should you be interested in listening to the full webinar recording, click here.