3 reasons why private equity should build a proprietary data engine

But why?

-

Competition for the best deals is at an all-time high;

-

Firms are feeling tacit or explicit pressure from LPs; and

-

The opportunity presented by the new suite of GenAI tech is too big to ignore.

All three of these tailwinds have contributed to a surge of interest in building in-house proprietary market databases. GPs are looking for an operational step change in the way they originate deals, build relationships and close transactions - and using data and AI to power the origination and dealmaking function is an exciting prospect.

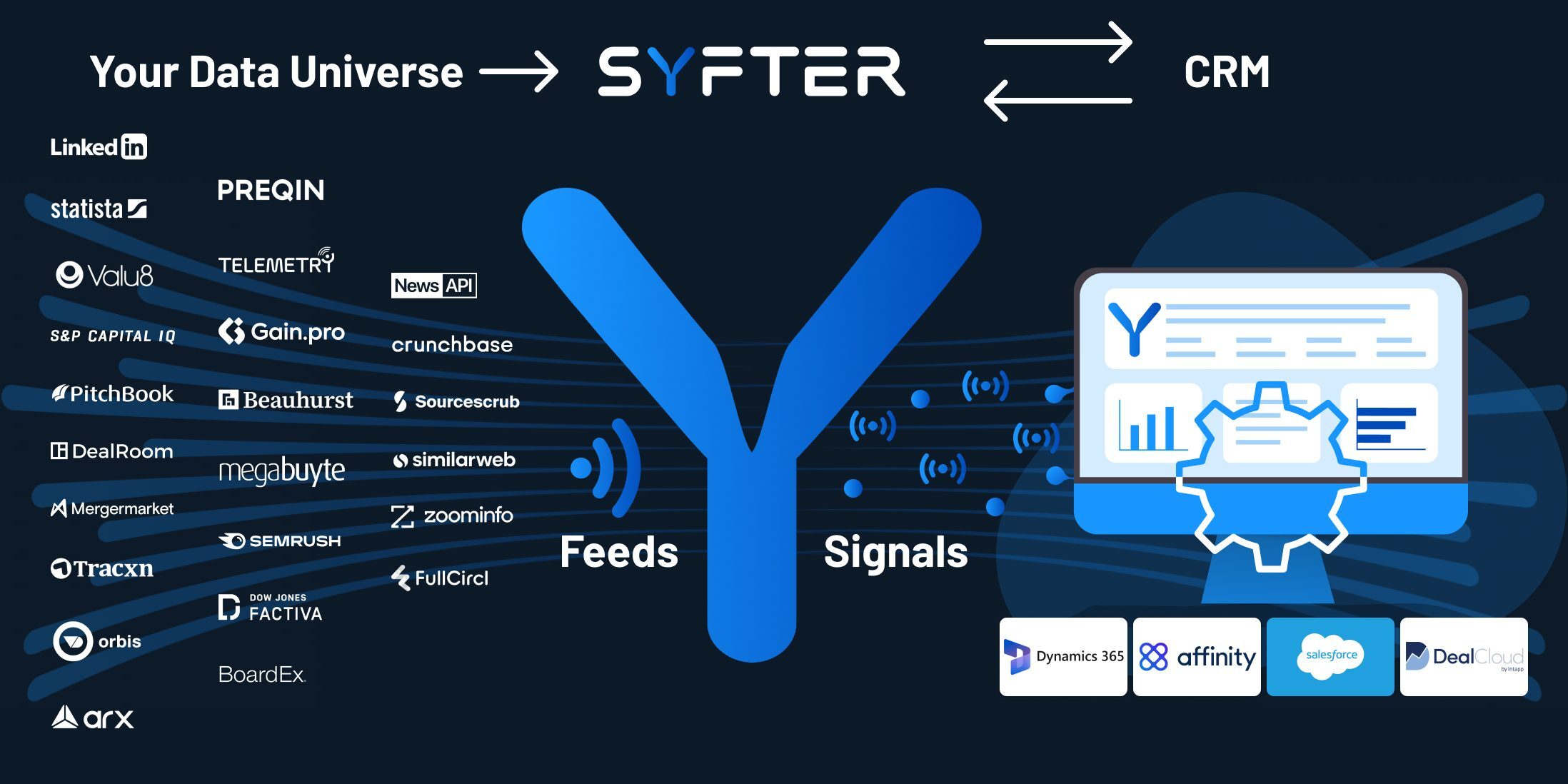

While firms may have the desire to bring their data intelligence in-house, many don’t know where - or HOW - to begin. Having a rich internal database of their addressable market, integrating with in-house ‘systems of record’ (CRM, documents, portfolio monitoring and management, etc. data all in one place) is the end goal, but it doesn’t have to be a long journey to get there.

Building proprietary systems in private equity

It’s a truism of AI from the outset that in order to gain alpha, you need to accumulate, own and enrich your own data. The answer is not to buy more seats on the ever dizzying array of SaaS data platforms, all of which have their specialist capabilities and GenAI tools, but ultimately are available to anyone with the budget to arm their teams. Essentially this is buying someone else’s AI, not building your own.

Building proprietary requires data engineering. It means buying your data via API or other provisioning, and accumulating your unique market database for your addressable market. Some of our clients are now continuously tracking over one million companies in their addressable market, assembling over 160 million data points, enriched every day. This covers the Firmographic, News, Financials, Deal and People data for every company they may wish to invest in. By combining into a single 360 degree view of a private market company, the firm can codify their investment thesis for each fund strategy, yielding the best fit deals floating to the surface for their teams to interrogate.

You don’t need to go it alone…

While proprietary is key, you don’t need to build from the ground up. Many PEs are hiring heads of data / AI and dev teams to meet this need. Most firms I talk to have started experimenting with models to codify their strategy, or experimenting with GenAI workflows. But to operationalize, the prospect is to build out an internal team of data engineers, data scientists and project managers to orchestrate an 18-month build phase. This carries risk, expense and significant time-to-value.

Deploy the private equity data engine where dealmakers work today

One challenge of any step change in technology deployment is the change management for your team. For that reason, we’ve helped our clients put the intelligence where the team work today.

Purpose-built PE data engine technology like Filament Syfter puts the firms’ intelligence in pop-up extensions, web searches, the firm’s CRM – wherever the dealmakers already spend their time. This massively helps with user adoption. Each and every member of the firm can receive alerts regarding new opportunities in their sector or sub-sector of interest, pushed via emails or Team, like an analyst scanning your market 24-7.

The Gen-AI gamechanger

A strong data architecture is the best way to position your firm to take advantage of the AI promise of the future. Today, “getting the data house in order” is both an operational imperative in today’s competitive private equity market and an opportunity. After the data is accumulated, cleansed and operationalized, PE firms can add fuel to the data lake, install a proprietary data engine, then leverage a plethora of GenAI-powered workflows.

Deploying a proprietary data engine at any private equity firm positively impacts all facets of the fund’s operations, including:

-

Next-gen deal origination - Enhanced ability to identify the best fit prospects in the market that are not on the radar of your fund

-

Automated opportunity tracking and relationship-building - Leverage insights that thell you when and with what content to reach out to favoured prospect

-

Programmatic creation of in-house IC material - Accelerated investment committee prep work and reduction of other administrative tasks

-

Decisive due diligence processes - Connecting live market input and benchmarking to the offline work of due diligence

-

Mechanized scanning of portfolio company performance and market perception - Increased transparency and connectivity with portfolio company managers and value creation teams with live market insight on their companies and competitive set

Conclusion

Filament Syfter has a core DNA in advanced private market data engineering and applied AI. Our technology and wrap around innovation culture makes us uniquely placed as the partner of choice to realise those ambitions.

If you’re a firm unsure where to start in your AI journey, we’d be delighted to speak with you.

Book a demo today to see the platform in action

-1.png)