Turning Private Markets Data Into Decision-Grade Intelligence

In its latest private markets report, the Citi Institute makes one conclusion abundantly clear: data, AI, and digitalization are no longer optional enhancements — they are the primary sources of competitive edge for private equity firms navigating an increasingly complex investment landscape.

From sourcing and screening to diligence, IC preparation, and portfolio monitoring, AI is being applied across the full investment lifecycle.

At Filament Syfter, this framing strongly resonates with what we see every day working alongside private equity firms building custom, firm-specific AI engines, which is why we acted as a contributor to the report. See below for key takeaways for firms navigating AI deployment in 2026:AI’s real impact starts upstream — in data strategy

Citi highlights a foundational truth that is often underestimated: AI is only as powerful as the data strategy beneath it. Private markets data remains fragmented, unstructured, and locked across CRMs, VDRs, emails, PDFs, portfolio systems, and human conversations. Unlike public markets, there is no standardized disclosure layer to rely on.

This is precisely why off-the-shelf AI tools struggle to deliver sustained value in private equity. Without centralized, permissioned, and governed data pipelines, AI outputs risk being shallow, inconsistent, or — worse — wrong. Citi’s emphasis on a central data repository augmented by AI tools mirrors Filament Syfter’s core belief: competitive advantage is created when firms unify proprietary data with external intelligence and apply AI natively to their workflows, not bolted on afterward.

AI use cases across the deal funnel — practical, not theoretical

Citi’s figures outlining AI use cases across the private markets deal funnel underscore how tangible these applications have become. AI-enabled sourcing and screening now extend far beyond keyword search, enabling firms to analyze market data, web signals, and internal deal history to surface non-obvious targets. During diligence, AI supports benchmarking, risk identification, scenario analysis, and document synthesis at a scale impossible for human teams alone.

Crucially, Citi emphasizes that AI is augmenting — not replacing — investment professionals. The firms seeing the greatest gains are those using AI to compress time-to-insight, sharpen judgment, and elevate human decision-making. This is exactly where custom data engines excel: they are trained on a firm’s own investment philosophy, historical decisions, sector focus, and language, ensuring outputs are contextually aligned with how that firm actually invests.

From productivity gains to outcome optimization

While much early AI adoption has focused on efficiency — summarizing documents, drafting memos, extracting clauses — Citi notes a clear shift toward improving outcomes, including better deal origination, portfolio oversight, and client engagement. This transition requires more than generic generative AI. It requires agentic workflows, governed data access, and models that can reason across a firm’s full information stack.

Filament Syfter’s experience supports Citi’s observation that firms increasingly favor building AI capabilities where data is sensitive and differentiating, while selectively buying tools for commoditized functions. The future is not build or buy — it is intelligent orchestration across both.

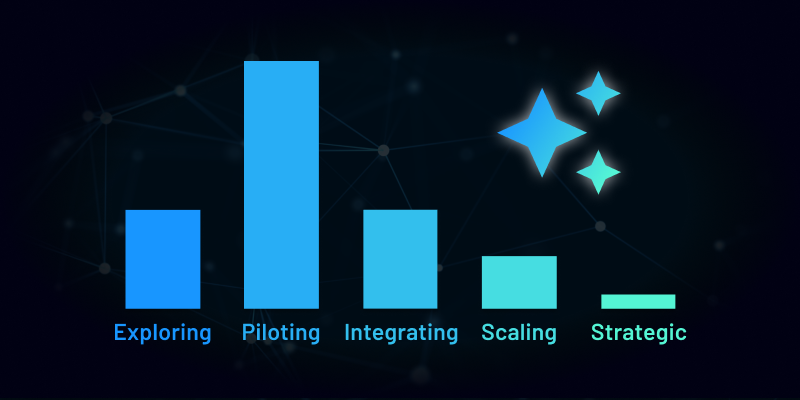

AI as infrastructure, not experimentation

Perhaps the most important takeaway from Citi’s analysis is that AI in private markets is moving out of experimentation and into core infrastructure. As reporting becomes more frequent, LP expectations rise, and public-private boundaries blur, firms without scalable AI-ready data foundations will struggle to keep pace.

For private equity leaders, the message is clear: the question is no longer whether to deploy AI, but how deliberately and how deeply. Custom AI engines, designed around a firm’s data, workflows, and strategy, are fast becoming the difference between firms that react to change and those that compound advantage from it.

Find out more about how to build an effective data engine that ensures you never miss a deal: Get your demo today

.png)